Vermont Law School's Environmental Tax Policy Institute analyzes the ways in which taxation can be used to address environmental problems. By serving as a resource for the public and private sectors, non-governmental organizations, the press and academia, the Institute seeks to better inform the public policy debate about the role of environmental taxes at the local, state and federal levels.

Carbon Taxes

The Environmental Tax Policy Institute is exploring issues relating to the use of carbon taxes at the state level. For example, the Environmental Tax Policy Institute’s Director, Professor Janet Milne, presented a paper on “Carbon Pricing in the Northeast: Looking through a Legal Lens” at the annual symposium of the National Tax Association, now published in the National Tax Journal. In Fall 2016 the Institute led a project that developed two briefing papers that can help inform state-level policymaking. Carbon Pollution Taxes: A Short Vermont Primer by Professor Janet Milne provides an introduction to carbon taxes. An Introductory Note on Carbon Taxation in Europe by Professor Mikael Skou Andersen at Aarhus University in Denmark offers perspectives on international experiences with carbon taxes.

Annual Global Conference

Over the past 20 years, the Global Conferences on Environmental Taxation have become a useful and important meeting place for experts and scholars from all parts of the world who are interested in experiences and insights relating to environmental taxation and other market-based instruments. The Environmental Tax Policy Institute frequently is a supporting partner of the annual conference and it hosted the 3rd Global Conference on Environmental Taxation in 2002. The Institute's Director, Professor Janet Milne, is a member of the steering committee for the conference series.

The 24th Global Conference on Environmental Taxation will be held in Paris, France on September 06-08, 2023. Chaired by Professors Christian de Perthuis and Edouard Civel, Paris-Dauphine-PSL University is the organizing host in partnership with the Toulouse School of Economics and the National Museum of Natural Science. The theme of this year's conference, Climate & Biodiversity: Tackling global footprints, will cover a broad range of topics addressing how and why environmental taxation and other economic tools can tackle biodiversity loss and climate vulnerability—including from the perspectives of agriculture and forestry, urban areas, supranational regulations, and more. More information for this event, including registration details, can be found here.

The 23rd Global Conference on Environmental Taxation was held both virtually and in Parma, Italy on September 21-24, 2022. Hosted by the University of Parma and chaired by Professor Alberto Comelli, the conference theme was The Green Growth Challenge. The program offered participants the opportunity to explore the role of taxation and other market-based instruments in achieving the transition to green economies and safer environments around the world. See here for more information.

Learn more about previous conferences here.

Environmental Taxation and the law

This two-volume book, published in 2017, assembles key articles written by experts around the world that explore how the law shapes the design and use of environmental taxation. Edited by the Environmental Tax Policy Institute, Director, Janet Milne, it serves as an important resource for people who work with environmental taxation and want to have seminal resources readily available on their bookshelf.

Click here for more information.

Handbook of Research on Environmental Taxation

Published in 2013, the Handbook provides an interdisciplinary, international tour of the key areas of research on environmental taxation. Edited by Janet E. Milne (the Director of the Environmental Tax Policy Institute) and Mikael Skou Andersen, the Handbook contains chapters written by 36 environmental tax specialists from 16 countries.

Click here for more information.

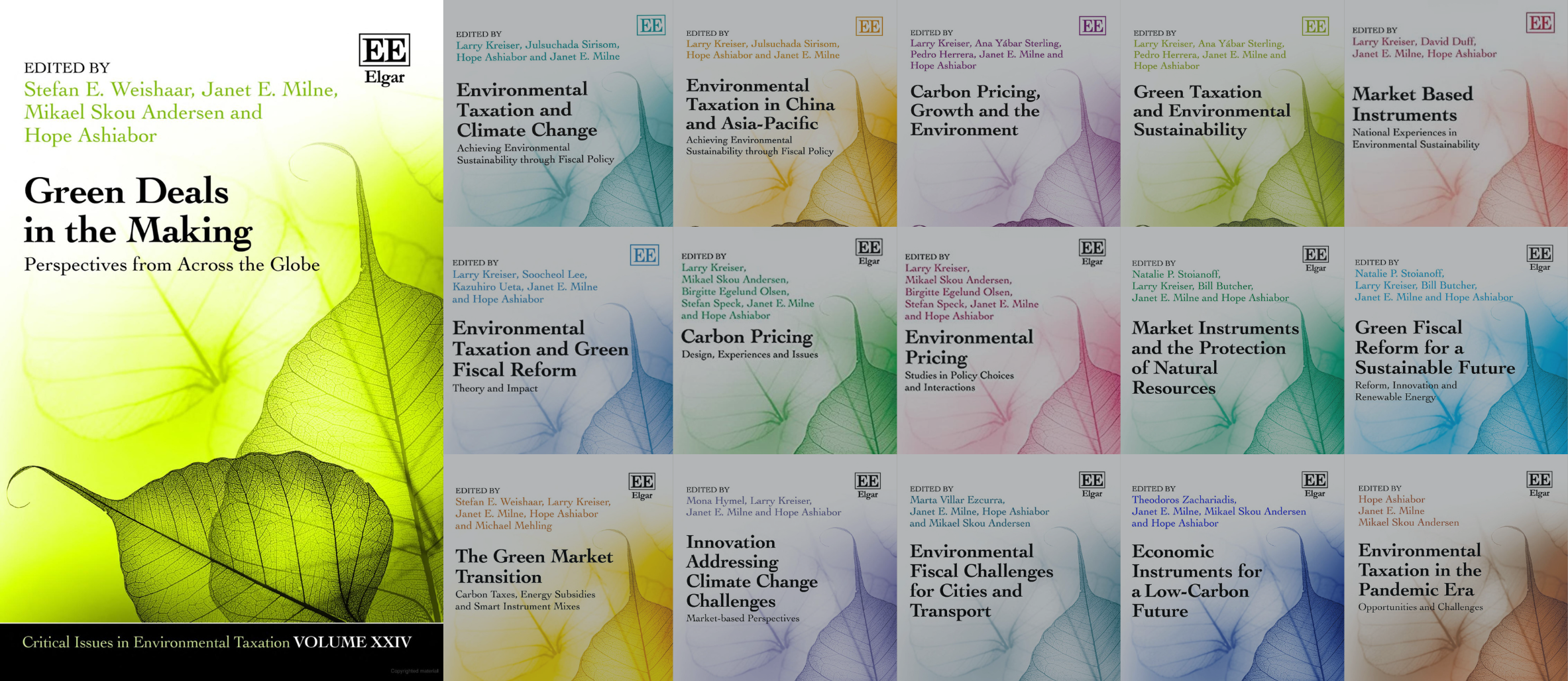

Critical Issues in Environmental Taxation

Volumes I through XXIV

The Global Conferences on Environmental Taxation yield numerous papers on environmental taxation, written by environmental tax specialists around the world. Selected, peer-reviewed papers are published in the book series, Critical Issues in Environmental Taxation, now published by Edward Elgar. The Environmental Tax Policy Institute’s Director, Professor Janet Milne, is a co-editor of the series.

The most recent volume, Green Deals in the Making: Perspectives from Across the Globe, Vol. XXIV (Stefan E. Weishaar et al., eds.) was published in 2022.

Environmental Taxation in the Pandemic Era: Opportunities and Challenges, Vol. XXIII (Janet E. Milne et al., eds. 2021).

Economic Instruments for a Low-carbon Future, Vol. XXII (Theodoros Zachariadis et al., eds. 2020).

Environmental Fiscal Challenges for Cities and Transport, Vol. XXI (Marta Villar Ezcurra et al., eds. 2019).

Innovation Addressing Climate Change Challenges: Market-Based Perspectives, Vol. XX (Mona Hymel et al., eds. 2018).

The Green Market Transition: Carbon Taxes, Energy Subsidies and Smart Instrument Mixes, Critical Issues in Environmental Taxation, Vol. XIX (Stefan E. Weishaar et al., eds. 2017).

Green Fiscal Reform for a Sustainable Future: Reform, Innovation and Renewable Energy, Critical Issues in Environmental Taxation, Volume XVII (Natalie Stoianoff et al., eds. 2016).

Environmental Pricing: Studies in Policy Choices and Interactions Critical Issues in Environmental Taxation, Volume XVI, (Larry Kreiser et al., eds. 2015).

Carbon Pricing Design, Experiences and Issues, Critical Issues in Environmental Taxation, Volume XV, (Larry Kreiser et al., eds. 2015).

Environmental Taxation and Green Fiscal Reform: Theory and Impact, Critical Issues in Environmental Taxation, Vol. XIV (Larry Kreiser et al., eds. 2014).

Market Based Instruments: National Experiences in Environmental Sustainability, Critical Issues in Environmental Taxation, Vol. XII (Larry Kreiser et al., eds. 2013).

Green Taxation and Environmental Sustainability, Critical Issues in Environmental Taxation, Vol. XII (Larry Kreiser et al., eds. 2012).

Carbon Pricing, Growth and the Environment, Critical Issues in Environmental Taxation, Vol. XI (Larry Kreiser et al., eds. 2012).

Environmental Taxation and Climate Change, Critical Issues in Environmental Taxation, Vol. X (Larry Kreiser et al., eds. 2011).

Environmental Taxation in China and Asia-Pacific, Critical Issues in Environmental Taxation, Vol. IX (Larry Kreiser et al., eds. 2011).