Layout Builder

ETPI Events

ETPI

Apply »

Summer Session Application for non-degree-seeking students

Summer FAQ »

Covering the most common questions asked about VLGS Summer Session

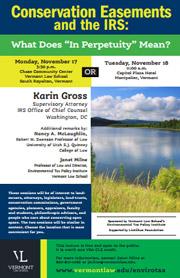

In Vermont and around the country, people are having conversations about the extent to which conservation easements can be amended or terminated when they have been granted "in perpetuity." An essential part of that discussion is, "What does the IRS think?" Donated easements must be perpetual to qualify for federal income tax benefits.

This expert panel provided a unique opportunity to hear directly from a supervisory attorney at the IRS deeply involved in this issue.

Karin Gross, Featured Speaker

Supervisory Attorney, IRS Office of Chief Counsel, Washington, DC

Nancy A. McLaughlin

Robert W. Swenson Professor of Law at the University of Utah S.J. Quinney College of Law and national academic expert on conservation easements

Janet E. Milne

Professor of Law and Director the Environmental Tax Policy Institute at Vermont Law School

These sessions will be of interest to landowners, attorneys, legislators, members of land trusts and conservation commissions, government agencies that work on open space protection, planners, appraisers, academics, philanthropic advisors, and people who care about conserving open space.

The two sessions will be similar in content. Choose the location that is most convenient for you.

Each session is free and open to the public and is worth one VBA CLE credit.

Sponsored by Vermont Law School's Environmental Tax Policy Institute.

Supported by the Lintilhac Foundation.

For more information, contact Janet Milne at 802-831-1266 or jmilne@vermontlaw.edu.